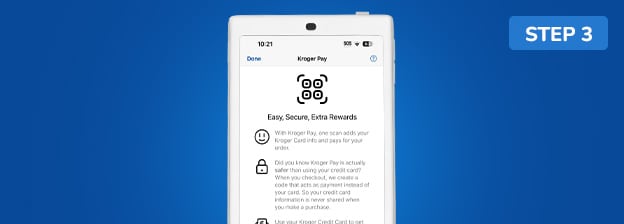

Setting up Kroger Pay

Use In Store & At the Pump

Use In Store & At the Pump

Quick & Convenient

Quick & Convenient

Safe & Secure

Safe & Secure

Always Free to Enroll & Use

Always Free to Enroll & Use

How to Use Kroger Pay In-store

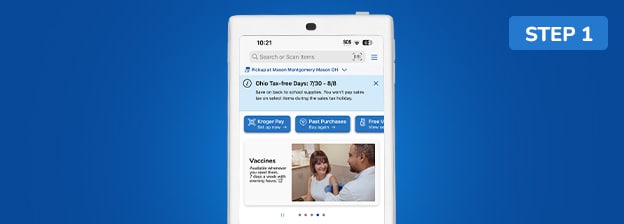

Tap “Kroger Pay” in the App

In the top left corner of the home screen.

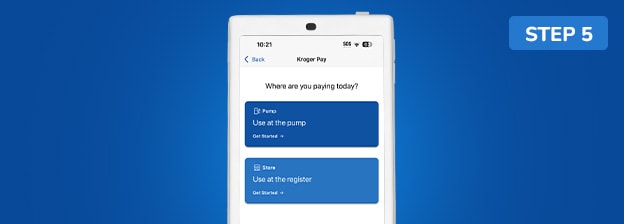

Select “Use at the Register”

To generate your unique QR code.

Scan to Pay

Show the associate or scan during self-checkout.

Tap “Kroger Pay” in the App

In the top left corner of the home screen.

Select “Use at the Register”

To generate your unique QR code.

Scan to Pay

Show the associate or scan during self-checkout.

Need More Details?

Before you begin scanning your items, hold the QR code over the scanner and wait for the beep. Next, tap “Pay” on the checkout screen, then “Mobile Pay” to wrap it up.

At any time during the checkout process, show the checkout associate your QR code (not pictures of your dog), and you’re done! Now, show the dog pics.

For security, a new QR code is generated each time you log in to use Kroger Pay! This keeps your payment information secure, but makes it so a screenshot will not work for payment.

How to Use Kroger Pay at the Pump

Tap “Kroger Pay”

In the top left corner of the home screen.

Select “Use at the Pump”

And enter your pump number.

Make Selections in the App

Choose any fuel discounts and select your payment method.

Pump Your Gas & Go

You can view your digital receipt in the app.

Tap “Kroger Pay”

In the top left corner of the home screen.

Select “Use at the Pump”

And enter your pump number.

Make Selections in the App

Choose any fuel discounts and select your payment method.

Pump Your Gas & Go

You can view your digital receipt in the app.

Kroger Pay Tips & Tricks

Explore the many ways to access Kroger Pay easily from your phone, in Store Mode, ask Siri or Google Assistant, tap the mobile app quick link or long tap on the app icon and select Kroger Pay. No need to type in your alternate ID. Using Kroger Pay automatically applies your loyalty information. Now you’re ready to redeem digital coupons and checkout with Kroger Pay!

Explore More

Download the App

To begin using Kroger Pay today! Plus, clip coupons, manage your account, and place pickup or delivery orders to make shopping easy.Download the App

To begin using Kroger Pay today! Plus, clip coupons, manage your account, and place pickup or delivery orders to make shopping easy.Frequently Asked Questions

- Once you’ve downloaded the App, if Kroger Pay is available in your location, there are a number of ways you can access it:

- Voice (Siri for iOS devices and Google Assistant for Android)

- App Shortcut Menu

- Kroger Pay “Quicklink” on the top left of the app Home Screen

- Kroger Pay button in Store Mode

- Kroger Pay button in your Wallet

- App More Menu

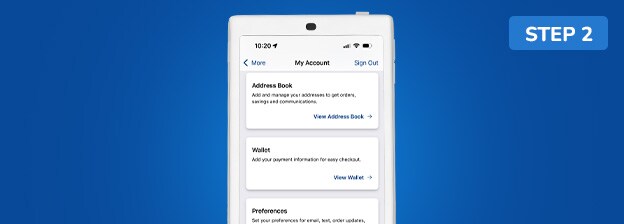

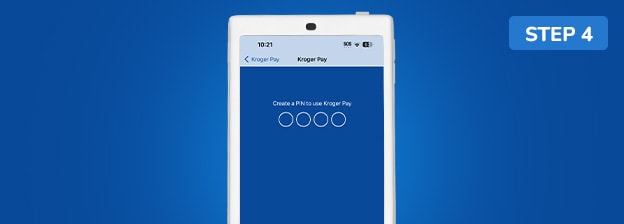

- Tap Kroger Pay and log into your existing Account. You will also be prompted to verify your phone number with twofactor authentication if you have not done so previously. You will be prompted to create a four-digit PIN. You also have the option to use biometrics (such as facial recognition or fingerprint) to secure your Kroger Pay wallet.

- Ensure your “Shopping at” location is selected to your preferred store, which can be found on the home page within the App.

Kroger Pay is a fast, contact-free, safe way to pay and save using your mobile device at participating in store and fuel center locations in the Kroger Family of Companies. Kroger Pay generates a one-time use quick response code (“QR Code”) that securely transmits payment and loyalty information from your mobile phone at check out. In addition, your Kroger Pay wallet is linked to your Kroger Co. Family of Stores Rewards program loyalty account, enabling you to automatically accrue loyalty points when making an eligible purchase using Kroger Pay. Simply scan the Kroger Pay QR Code at any time during checkout for a faster, more convenient experience.

Kroger Pay is accepted at participating in-store locations* in the Kroger Family of Companies in the United States. Kroger Pay can be used in-store at attendant or self-checkout lanes, in-store Pharmacy checkout and Beer, Wine & Liquor locations (where available). Kroger Pay is also accepted at Kroger Fuel Centers. Kroger Pay currently is not available for use in Pharmacy drive-thru lanes. Kroger Pay is not accepted at certain independent merchants within Kroger stores or online and cannot be used at stores outside of the Kroger Family of Companies.

Yes. As part of our ongoing effort to protect and support our associates and customers, Kroger Pay is a secure way to pay for your groceries with no contact necessary. Visit our COVID-19 information page to see the additional steps we’re taking to ensure your safety.

To set up Kroger Pay, first you will need to have a digital account with one of the Kroger Family of Companies (“Account”) and download a Kroger Co. Family of Stores App (“App”) on a Kroger Pay-compatible mobile device. You can download the App from the App Store (iOS) or Google Play Store (Android).

Any payment cards you have saved to your digital wallet are available to use within Kroger Pay. After you’ve entered your four-digit PIN or scanned your biometrics, you will see your default card at the bottom of the screen. Clicking on it will show all cards saved in your digital wallet. You can set a default payment method and change your payment method at any time. You can load additional eligible payment cards for use in Kroger Pay into your digital wallet via the App or by logging into your Account online.

KROGER PAY

¹Restrictions apply, “contact-free” applies to transactions through staffed registers only.

²To view Kroger Pay in our mobile app, please make sure you have the most recent app version (24.0 or later).

Kroger Financial Products Privacy Policy

Kroger Rewards Debit Cards Terms & Conditions

Kroger Family of Companies Rewards World Elite Mastercard®

³Mobile Wallet and Kroger Pay 5% Cash Back: Kroger Pay non-fuel transactions earn 5% cash back on the first $3,000 in purchases each calendar year and 2% on amounts above that. Kroger Pay transactions at Fuel Centers do not earn rewards. Mobile wallet transactions (excluding Kroger Pay) earn 5% on the first $3,000 in purchases each calendar year and 1% on amounts above that, regardless of where the transaction was made, including Kroger Family of Companies locations. "Mobile wallet" means Apple Pay®, Samsung Pay, Google Wallet®, and Garmin Pay Unlike Google Wallet®, Google Pay® may not qualify as a mobile wallet and earn additional cash back, depending on how the transaction is completed. We cannot control how mobile wallet transactions are designated and reserve the right to determine which purchases qualify for additional cash back. If a Kroger Pay or Mobile Wallet transaction might also qualify as a rewards category transaction, then the card issuer has sole discretion on how to categorize the transaction. “Calendar Year” is defined as the period of time starting with your January statement (which may include transactions made in December) and running through your December statement (which may not include all transactions made in December).

⁴BOOST: Boost offer applies to new credit cardmembers who apply and are approved for the Kroger Family of Companies Rewards World Elite Mastercard®. Must enroll for Boost Membership and provide payment information to activate your membership and receive free Boost Essential Membership. If you choose the $99/year Boost Membership, you will receive a $69 waiver upon enrollment. If you close your Kroger Family of Companies Rewards World Elite Mastercard® account, you will be charged for the annual Boost Membership if you don’t cancel prior to the end of your membership period. An annual membership currently costs $69/year for the Boost Essential Membership and $99/year for the Boost Membership, but the cost of the yearly membership is subject to change. You can cancel any time by visiting your membership page. If you decide to cancel, your current Boost benefits will be available until the end of your membership period. Only one free Boost Essential Membership per household. Offer cannot be used for payment of current Boost Membership. See The Kroger Family of Companies website for more information regarding Boost Membership.

$1 in spending = 1 Fuel Point + 1 bonus Fuel Point on qualifying purchases made in-store, curbside pickup and delivery. Gift cards, adult beverage, tobacco products, pharmacy prescriptions, Booth Service, Kroger Ship, The Little Clinic, Fred Meyer Direct, Fred Meyer Jewelry, Vitacost, homechef.com, murrayscheese.com, Fuel purchases, or receipt message survey invitations are excluded from Boost Fuel Points benefits. Fuel Points can be redeemed at participating fuel locations.

⁵$100 STATEMENT CREDIT: Offer applies to new cardmembers only. For a limited time only. Subject to credit approval. Must submit application, be approved for the Kroger Family of Companies Rewards World Elite Mastercard® and spend $500 in net purchases within 90 days of Account opening to automatically earn the $100 cash back. Net purchases are purchases minus credits and returns. The $100 cash back will be applied as a statement credit on your Account. Please allow 6-8 weeks after the promotion period for your $100 statement credit to be credited to your Account. Your Account must be open and in good standing to receive this bonus. Upon approval, please refer to your Cardmember Agreement for additional information.

The creditor and issuer of this card is U.S. Bank National Association, pursuant to a license from Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.